NEWS: Brim announced as winner of Deloitte's Technology Fast 50™ for 2022. Read More

NEWS: Brim announced as winner of Deloitte's Technology Fast 50™ for 2022. Read More

Mastercard and Brim Sign Strategic Partnership to Innovate Credit Card Solutions in the U.S.Learn More

Meet the first fintech in Canada licensed to issue credit cards.

Discover the real stories behind our success – where happy customers turn their experiences into heartfelt testimonials.

Explore what we’re up to from news features, blogs, and beyond.

Forge Your Future: Join our team and shape the next chapter in your career journey.

Meet the first fintech in Canada licensed to issue credit cards.

Discover the real stories behind our success – where happy customers turn their experiences into heartfelt testimonials.

Explore what we’re up to from news features, blogs, and beyond.

Forge Your Future: Join our team and shape the next chapter in your career journey.

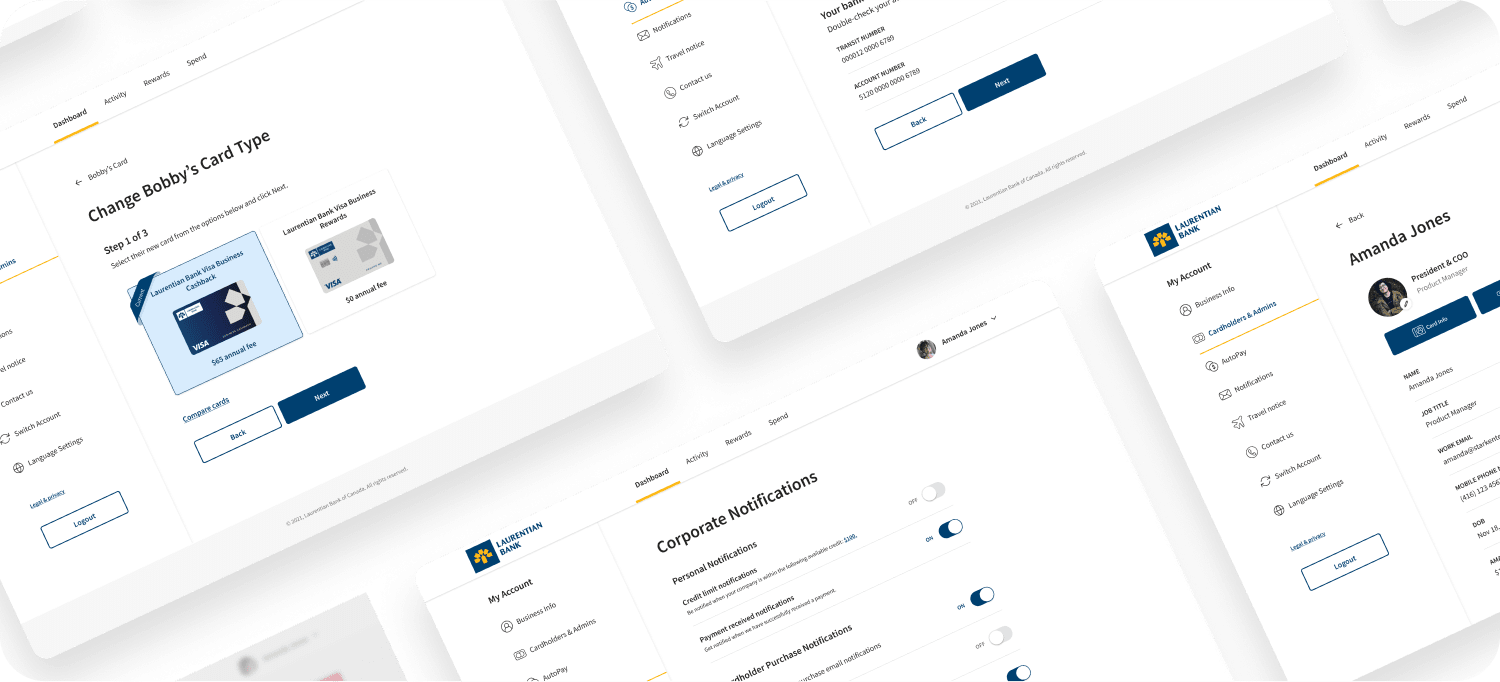

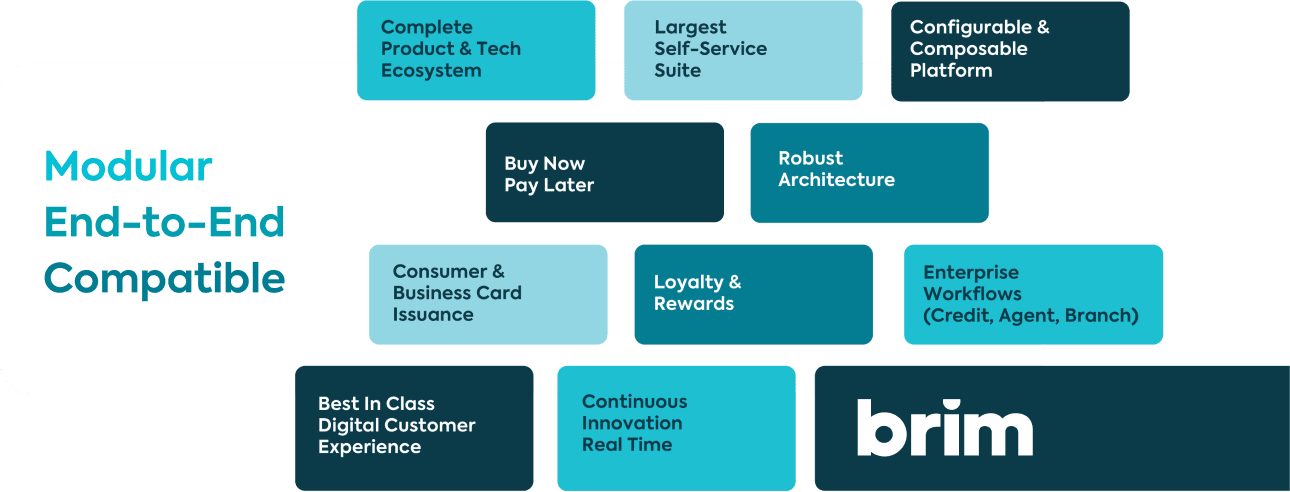

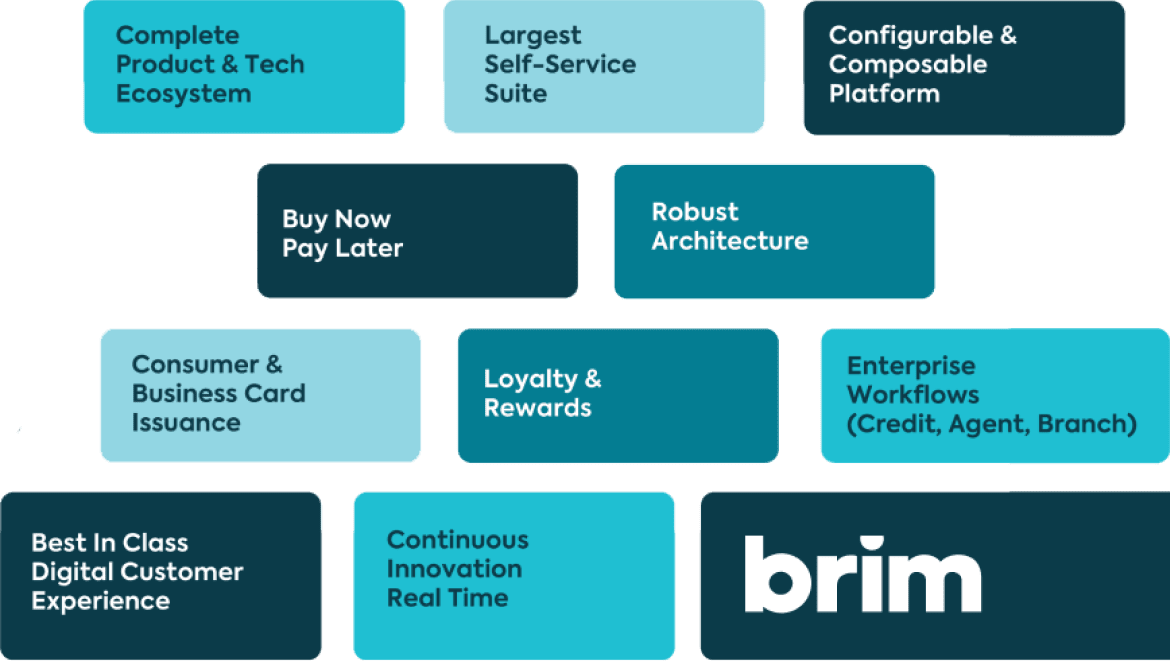

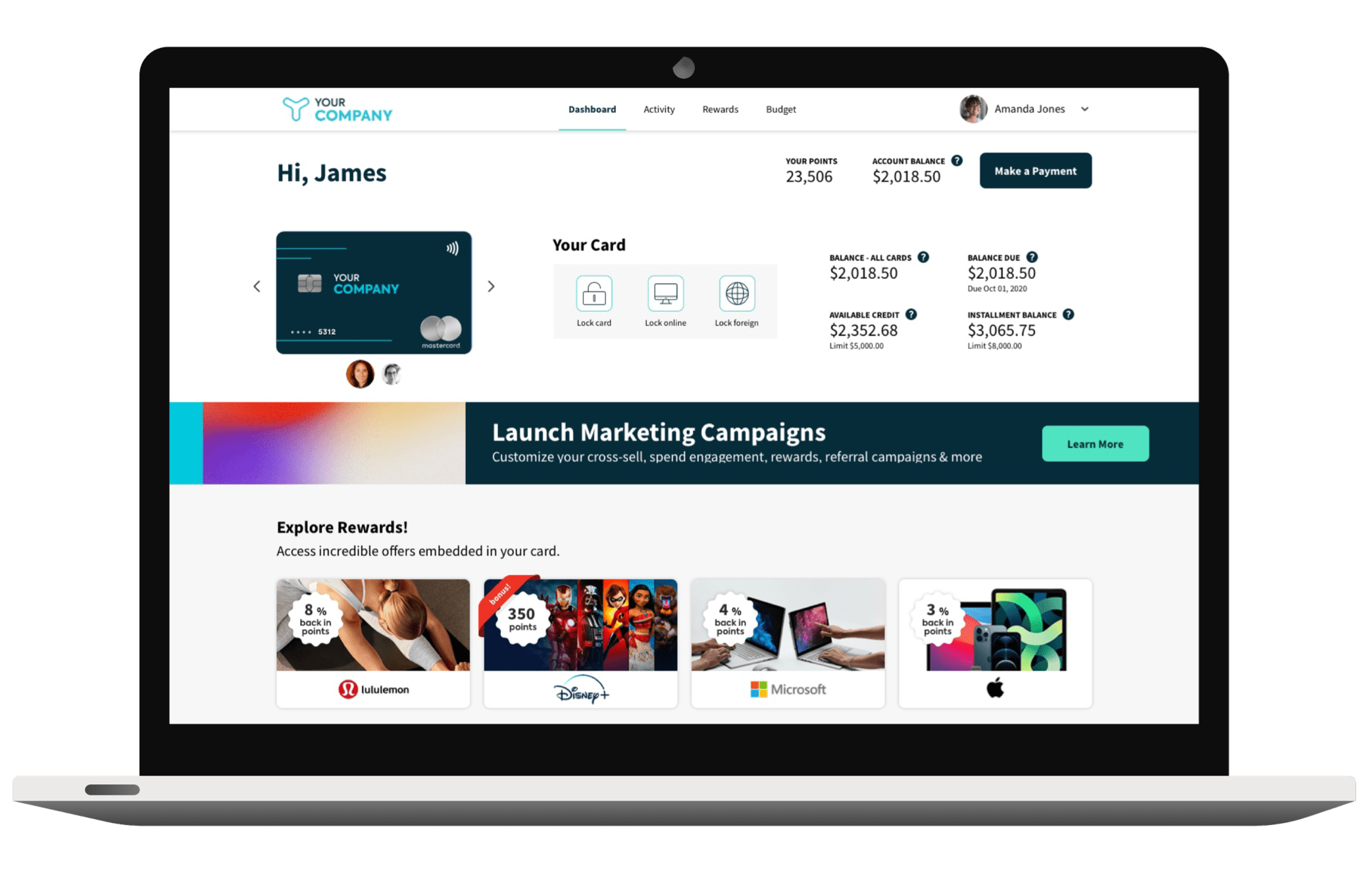

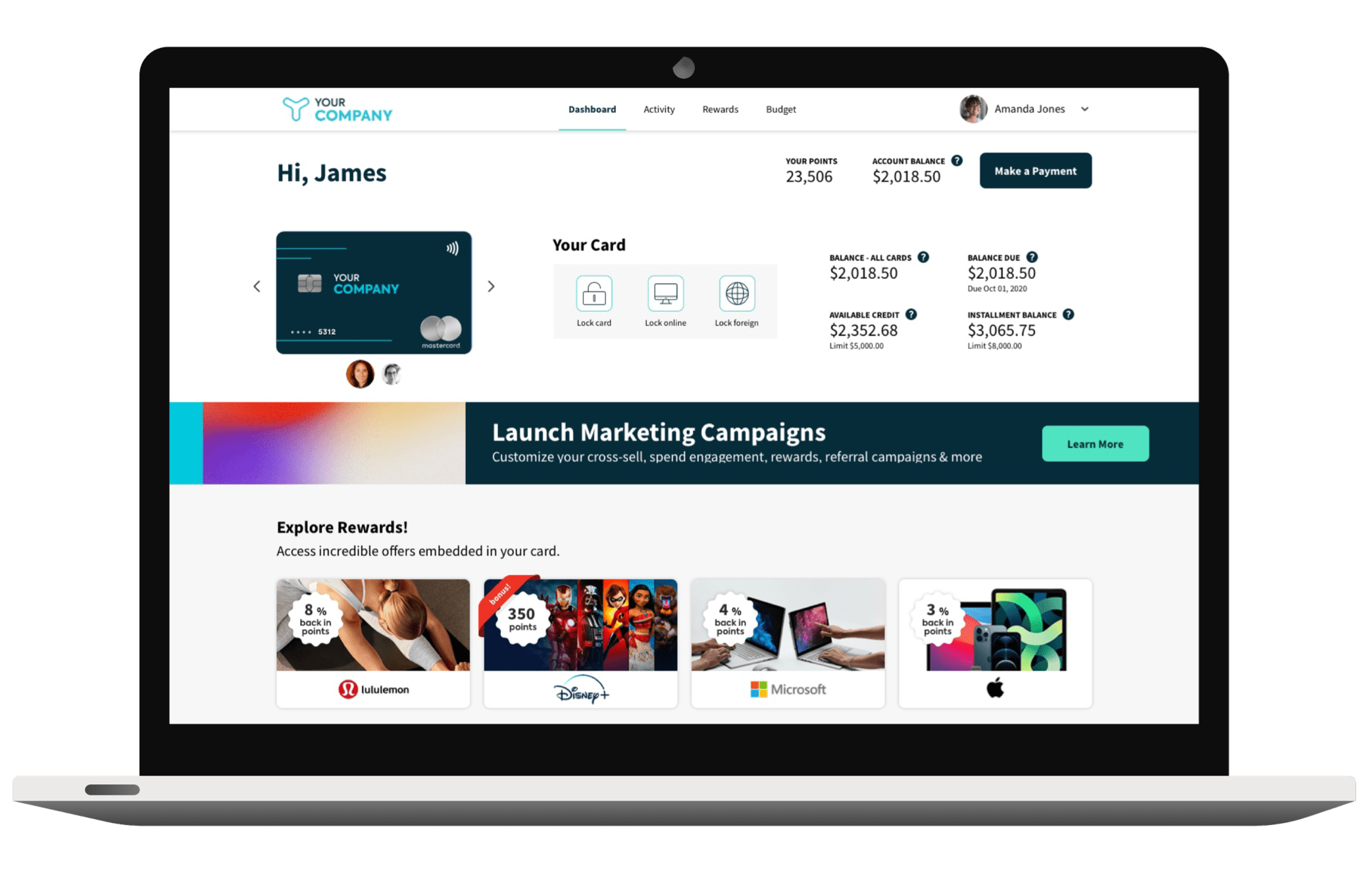

The largest self-service offering on digital first Credit Cards

Brim has partnered with Mastercard to support the launch and modernization of Credit Card Platforms in the US. Through this collaboration, financial institutions and fintechs can accelerate time to market for Credit Card Issuance and digital payments innovation.

Brim Financial ranks on Deloitte’s Technology Fast 50™ Canada and Technology Fast 500™ North America.

We are a fully-integrated platform that delivers real-time innovation for finance, globally. Financial institutions, fintechs, commercial operations, and merchants looking to re-platform financial services can launch or elevate customer experience and engagement with our end-to-end comprehensive PaaS.

Learn more

The 2022 Impact Report explores key trends within the CCaaS market and how innovation is helping to address new market needs and challenges.

Learn more

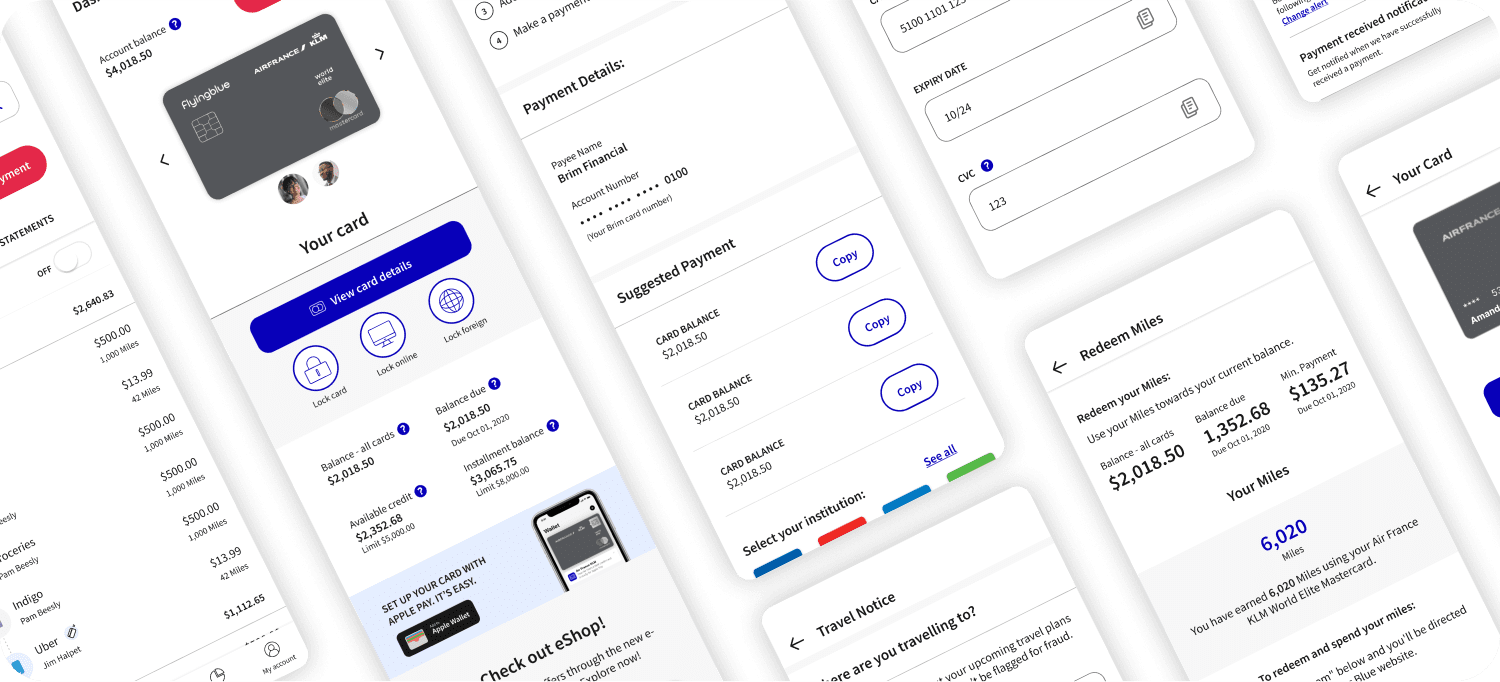

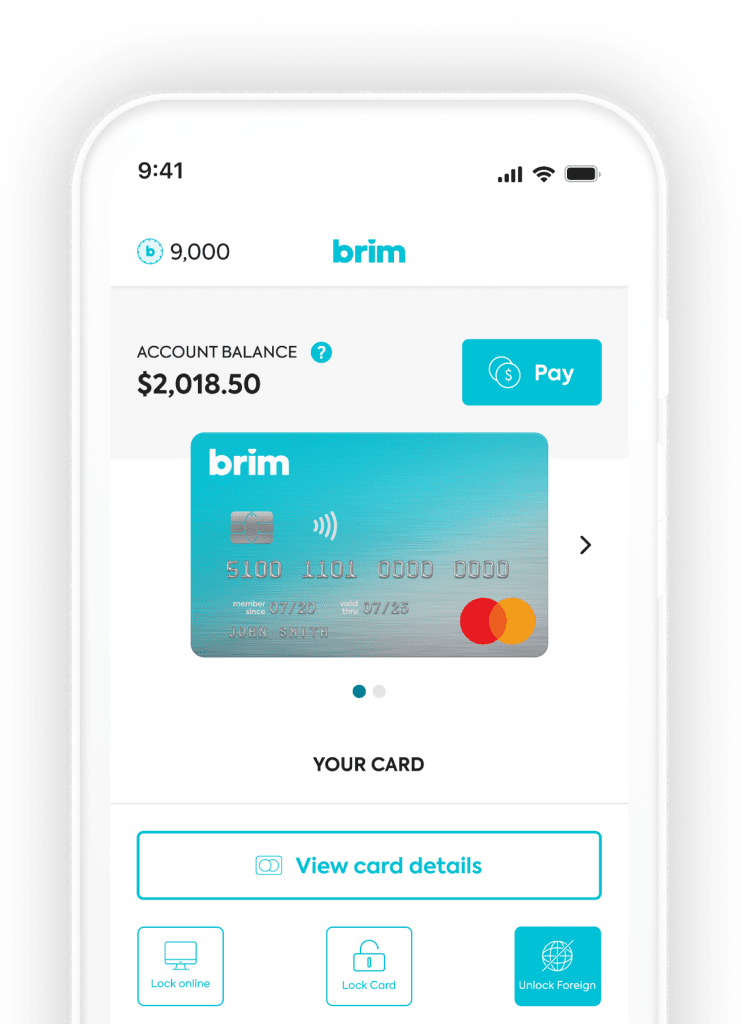

You deserve a credit card that offers best-in-class benefits, rewarding your everyday spending, security, and privacy. Access exclusive rewards and earn up to 30% back in points, manage your account seamlessly online or in app, and customize your preferences for the whole family.

Use a credit card that offers you best-in-class reward and perks. Brim offers personal credit cards that rewards you for your everyday purchases. Get Brim-only merchant loyalty rewards programs to up to 4% cash back* on purchases. Feel comfortable issuing digital credit cards with a modern management system that offers security, privacy, and flexibility for your whole family.

Learn more

Grow your direct-to-consumer and direct-to-business sales with frictionless, real-time rewards and offers. Brim partners with local and global brands to offer best-in-class rewards to customers. Offer highly customizable offers to drive sales and build customer loyalty – no upfront fees, no set-up and no integration.

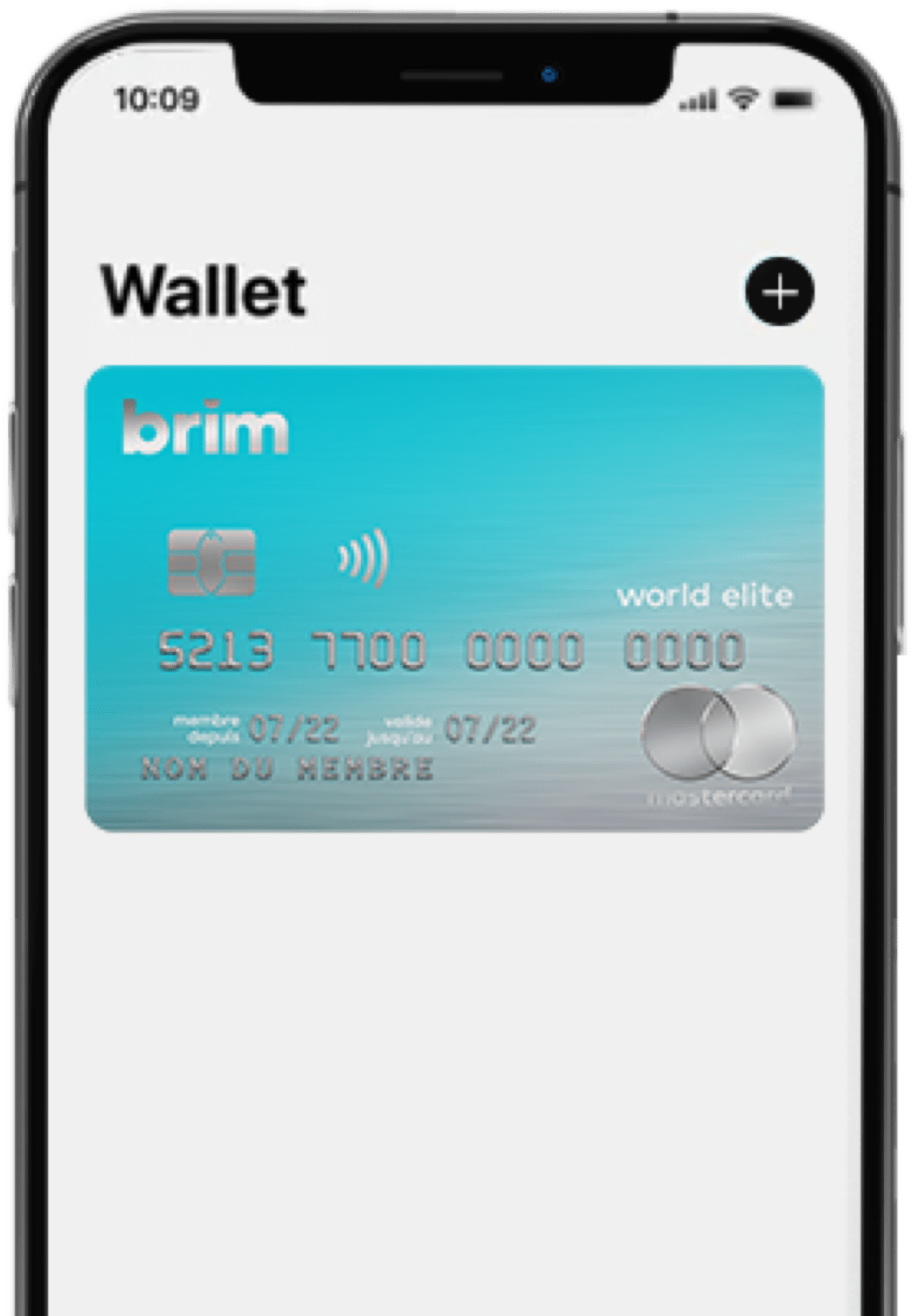

Apply now to your digital cards in seconds from your Apple Wallet. Use your Apple Watch or Apple Pay to start with Brim in seconds.

Together Brim and Mambu enable any Bank, Fintech or non-FI to seamlessly roll out a comprehensive and composable suite of card and banking products for businesses and consumers at market leading speed.

Choose the card that's right for you

“By integrating with Brim’s Platform-as-a-Service, we’ll be replacing our 5 vendors that service our Visa products from an end-to-end perspective. That simplifies things for us internally. We go from 5 vendors to 1 vendor.”

“Brim’s new offering of digital and instant card experiences allow us to seamlessly innovate and offer first-to-market features to our customers, delivering outstanding experiences and services, without having to build this and allocate resources internally - a significant competitive advantage.”

“Brim delivers stronger innovations. We aren’t playing catch up, we’re actually going and leading in the market and that’s very exciting for us."

“There is tremendous potential in the industry and Brim is uniquely positioned to deliver a significant and much-needed transformation.”

“As a small business, I’ve been able to be seen side-by-side with large global brands with Brim Rewards, expanding my reach. Brim is an extension of our team and has helped us be efficient and effective with our direct-to-consumer marketing channel.”

“[Cards] is one of our core focus areas in our personal banking space as we need to reimagine the end-to-end customer journey. Brim’s Platform-as-a-Service will eliminate 90% of our manual processes.”

“Buy now, pay later is another way we can support our customers, as well as increase sales and increase average transaction sizes. Buy now, pay later is embedded right in the Brim platform and there’s no POS set-up or integration on our side - it’s really simple.”

“I have been extremely pleased with every aspect of having my Brim card. The process has been seamless, and the customer support has been outstanding! Has been great being able to use my loyalty points where I want, and on top of it all - the card looks great :)!”

“By integrating with Brim’s Platform-as-a-Service, we’ll be replacing our 5 vendors that service our Visa products from an end-to-end perspective. That simplifies things for us internally. We go from 5 vendors to 1 vendor.”

“Brim’s new offering of digital and instant card experiences allow us to seamlessly innovate and offer first-to-market features to our customers, delivering outstanding experiences and services, without having to build this and allocate resources internally - a significant competitive advantage.”

“Brim delivers stronger innovations. We aren’t playing catch up, we’re actually going and leading in the market and that’s very exciting for us."

“There is tremendous potential in the industry and Brim is uniquely positioned to deliver a significant and much-needed transformation.”

“As a small business, I’ve been able to be seen side-by-side with large global brands with Brim Rewards, expanding my reach. Brim is an extension of our team and has helped us be efficient and effective with our direct-to-consumer marketing channel.”

“[Cards] is one of our core focus areas in our personal banking space as we need to reimagine the end-to-end customer journey. Brim’s Platform-as-a-Service will eliminate 90% of our manual processes.”

“Buy now, pay later is another way we can support our customers, as well as increase sales and increase average transaction sizes. Buy now, pay later is embedded right in the Brim platform and there’s no POS set-up or integration on our side - it’s really simple.”

“I have been extremely pleased with every aspect of having my Brim card. The process has been seamless, and the customer support has been outstanding! Has been great being able to use my loyalty points where I want, and on top of it all - the card looks great :)!”

Aite-Novarica Group ranked Brim's Credit-Card-as-a-Service as best-in-class for product capabilities in its analysis of the global landscope of Credit-Card-as-a-Service providers

Banking veteran Rasha Katabi raises one of largest venture financings for Canadian woman-led startup at Brim Financial

Brim received recognition as part of the 2022 Deloitte Technology Fast 50 awards program for its rapid revenue growth and bold innovation

Brim Financial is disrupting the Canadian market as a transformative financial technology company and licensed Mastercard issuer

Brim Financial has closed a $25 million CAD Series B as it looks to expand it's Platform-as-a-Service technology

Brim part of a growing crop of tech-enabled lenders that are looking to snap a share of the credit card market

Brim Financial, a Canadian next-generation Fintech company and certified credit card issue announces close of $25M Series B

Provides coverage for theft, loss, or damage to a rental car, up to the actual cash value of the rental car, for a rental period up to 48 days. No coverage is provided if the Manufacturer’s Suggested Retail Price (MSRP) of the rental car, in its model year, exceeds the MSRP shown in the Certificate of Insurance. You must decline the Loss Damage Waiver (LDW) or similar option offered by the car rental company and fully charge the car rental to your card.

Provides Travel Services such as: supplying pre-trip information and assistance, helping you replace your passport, airline ticket or helping you recover luggage if lost or stolen; helping you contact a local lawyer for legal assistance; helping you arrange for emergency cash; and providing emergency messaging services between you and your family, friends and business associates.

All insurances are underwritten by Royal & Sun Alliance Insurance Company of Canada

All insurances are underwritten by Royal & Sun Alliance Insurance Company of Canada

All insurances are underwritten by Royal & Sun Alliance Insurance Company of Canada